Recent FINRA Enforcement Trends and What to Expect in the Future

Webinar Recap

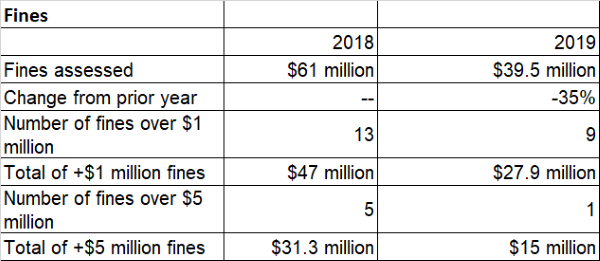

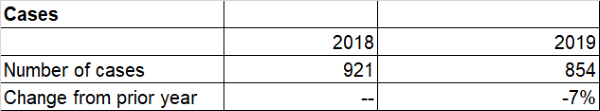

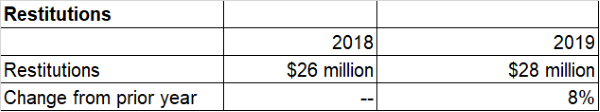

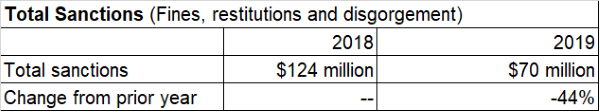

FINRA enforcement trends can be somewhat unpredictable. Last year saw a decrease in overall FINRA fines, restitution and cases when compared with the prior year, 2018. However, FINRA continues to target specific areas. For example, anti-money laundering violations, which — for the last four years — have resulted in the largest number of fines.

In a recent webinar, a panel of regulatory experts look back on 2019 and discuss what firms can do to avoid making the same penalties in 2020 while preparing for post-pandemic compliance.

The panel includes:

- Adam Pollet, Counsel at Eversheds Sutherland

- Brian Rubin, Partner at Eversheds Sutherland

- Marianna Shafir, Regulatory Advisor at Smarsh

About Eversheds Sutherland

Eversheds Sutherland is a global law practice that provides legal services to the world's largest corporate firms and has extensive data on past FINRA regulatory actions.

FINRA Regulatory Actions of 2019

Overall, there were fewer regulatory actions in 2019 than in 2018.

Top 5 Enforcement Actions of 2019

Eversheds Sutherland’s identified FINRA’s top enforcement issues of 2019 by looking at both the total number of fines and the total cost of fines within a category.

1. Anti-money laundering (ALM): 12 cases reported, $17.4 million in fines

2. Exchange-traded funds or products (ETF/ETP): 13 cases reported, $3.5 million in fines

3. Misleading or inaccurate information: 28 cases reported, $3.3 million in fines

4. Municipal securities: 8 cases reported, $2.7 million in fines

5. Suitability: 45 cases reported, $2.7 million in fines

Common FINRA Compliance Issues

FINRA’s most common actions and costly fines suggest what issues they may continue to focus on in 2020.

Anti-Money Laundering

AML made the top of the list for the fourth year in a row, indicating that the issue continues to be important to FINRA and other regulators.

“Anti-money laundering’s continued presence really confirmed what we've been seeing in FINRA,” says Pollet. “While the number of cases decreased in 2019 compared with prior years, the single largest AML case was $5 million more than the largest AML case in 2018, which also happened to be the largest single fine in 2018.”

529 Share Classes

FINRA has followed the SEC’s example of launching a self-reporting initiative focused on 529 share classes. However, FINRA has noted that while approximately 100 firms self-reported through the initiative, it was made clear that not all firms that self-reported would be sanctioned.”

“It's an odd position and dichotomy that firms are working with the FINRA despite the fact that their self-reporting can lead to being sanctioned,” says Rubin. “However, in 2019, self-reported cases resulted in 50% of the actions brought against investment advisors and investment companies. This has proven to be a good, efficient strategy if the regulators do want to bring impactful, meaningful cases without using a lot of time and energy and resources.”

Market Access Classes

FINRA, in coordination with various exchanges, brought a string of seven market access class cases in 2019. While FINRA fined those firms about $850,000, the exchanges assessed nearly $9 million in fines in those cases.

“While FINRA's portion of these fines may be relatively small, a firm should be anticipating that other exchanges may assess their own hefty fines for these types of violations,” says Pollet.

Recordkeeping

FINRA continues to fine firms that fail to comply with recordkeeping obligations. The largest recordkeeping fine in 2019 was $700,000 for failing to comply with recordkeeping obligations. The CCO was also barred and fined $100,000.

“We’re starting to see a trend where compliance officers are found to be personally liable,” says Shafir. “FINRA's cases against individuals for recordkeeping violations rose by 6% in 2019.”

Electronic Communication

The largest electronic communications case of 2019 resulted in a $32,500 fine. The firm's WSPs lacked methods for reviewing messages, and its current review process failed to properly flag potentially compromising emails.

“Firms need to ensure that they are sampling a reasonable amount,” says Shafir. “Unfortunately, there isn’t guidance on what ‘reasonable’ may mean, but there are cases where FINRA fined firms for reviewing 2% of their communications.”

FINRA Regulatory Compliance in 2020

“This year will see unique issues in response to the current COVID-19 pandemic and market downturn,” says Rubin. “We want to focus on a few issues where we think that there might be enforcement actions by FINRA, the SEC and the Department of Justice.”

COVID-19 Issues and Scams

Scammers are offering online promotions in various platforms, including social media, where they claim that they're publicly traded companies that could prevent, detect or cure COVID-19. There are research reports on these issues with target prices.

Cybersecurity and Technology

There's an increased risk of cybersecurity events during a pandemic when many employees are working remotely. Firms need to create a robust remote infrastructure to handle home demands while ensuring employee computers and mobile devices have the latest security updates.

Firms are still responsible for supervising the activities of remote workers, and now is a good time to review supervisory procedures and policies to ensure that they address the firm’s business and comply with the rules.

“Firms need to review electronic communication whether they’re direct messages, email, text or social media,” says Shafir. “Firms need to be able to capture, archive and supervise any of these communications — including communications on Slack, Microsoft Teams and Zoom.”

Insider Trading

With increased market volatility and constantly changing news, there’s an increased potential for insider trading activity. Family members or friends may also gain access to information by sharing workspaces or devices, so firms may need to heighten their surveillance and review on these issues.

Misrepresentations, Omissions and Suitability

It’s common for the SEC and FINRA to bring cases involving misleading descriptions about performance or investment risk suitability following a market crisis. Firms need to understand the product’s risks and communicate it in a way that the customer will understand.

“With these kinds of cases, emails are always critical,” says Rubin. “There were a lot of investigations on this issue after the 2008 financial crisis, and we expect the regulators to use a lot of the same plays.”

Product Failures

Litigants, claimants and regulators may argue that products weren’t designed properly, and not prepared to take into account activities such as market failures or a pandemic. The fight will be about the foreseeability of the crisis, and firms will need to perform due diligence on the products’ suitability.

Watch the full webinar here and read more from presenter Brian Rubin in this blog.

Share this post!

Smarsh Blog

Our internal subject matter experts and our network of external industry experts are featured with insights into the technology and industry trends that affect your electronic communications compliance initiatives. Sign up to benefit from their deep understanding, tips and best practices regarding how your company can manage compliance risk while unlocking the business value of your communications data.

Subscribe to the Smarsh Blog Digest

Subscribe to receive a monthly digest of articles exploring regulatory updates, news, trends and best practices in electronic communications capture and archiving.

Smarsh handles information you submit to Smarsh in accordance with its Privacy Policy. By clicking "submit", you consent to Smarsh processing your information and storing it in accordance with the Privacy Policy and agree to receive communications from Smarsh and its third-party partners regarding products and services that may be of interest to you. You may withdraw your consent at any time by emailing privacy@smarsh.com.

FOLLOW US