Set Your Compliance Journey Up for Success with Our 2025 Compliance Survey Insights

We’ve learned a lot about the regulatory and compliance landscape in 2024. We’ve decoded the SEC’s new vision for communication records, reviewed global AI regulations, and spent more than a few articles highlighting the urgency around getting your off-channel communications in order.

To prepare for the next year — as we often do — we polled 262 financial services organizations to learn how YOU are feeling about the state of compliance. Here’s what we’ve learned from your fellow compliance professionals.

Why it matters

There were a lot of regulatory and technological impacts on financial services this year. While it’s important to stay updated on what’s happening, it’s just as important to understand how it affects firms. Find out how your peers are responding to 2024 news and trends and what’s driving their compliance strategies for 2025.

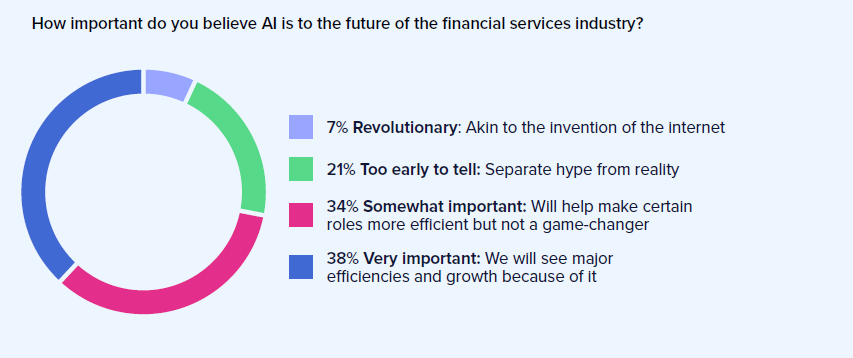

Artificial intelligence tools in financial services

Let’s get straight to one of the biggest talking points of the year: artificial intelligence and what it means for productivity, efficiency and, most importantly, compliance.

The AI impact on firms

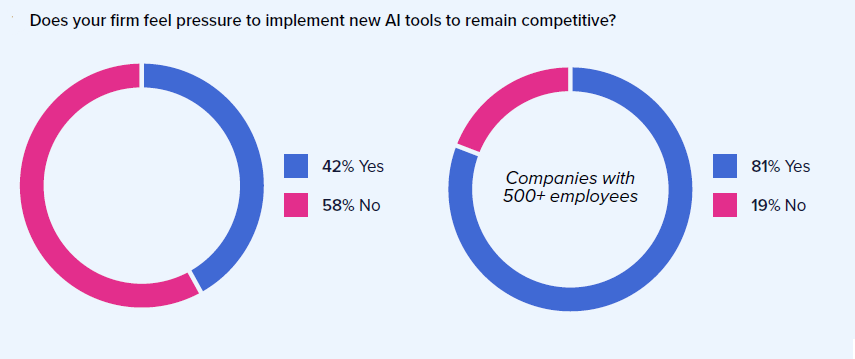

Clearly, the financial services sector agrees that AI tools will impact the industry in some form. The survey results show that a little less than half (42%) of respondents feel some level of pressure to adopt this new tool into their processes. However, for respondents from larger organizations, that skyrockets to 81%.

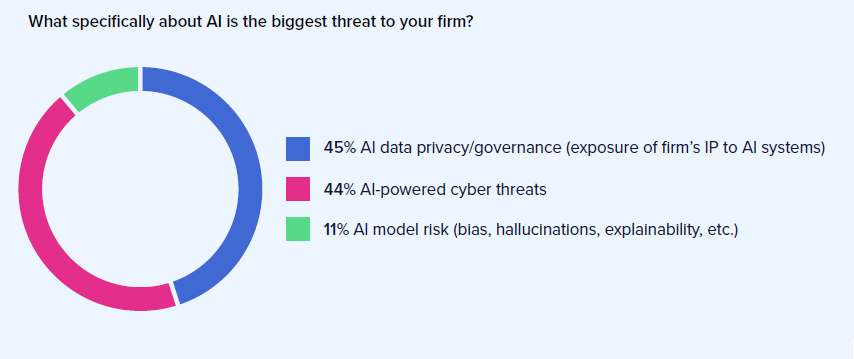

Concerns about AI tools add to that pressure. Interestingly, it’s not the efficacy of the tools — only 11% of respondents think that AI biases, hallucinations and explainability create the most anxiety. Rather, the majority of respondents (89%) think external AI threats are the biggest issue.

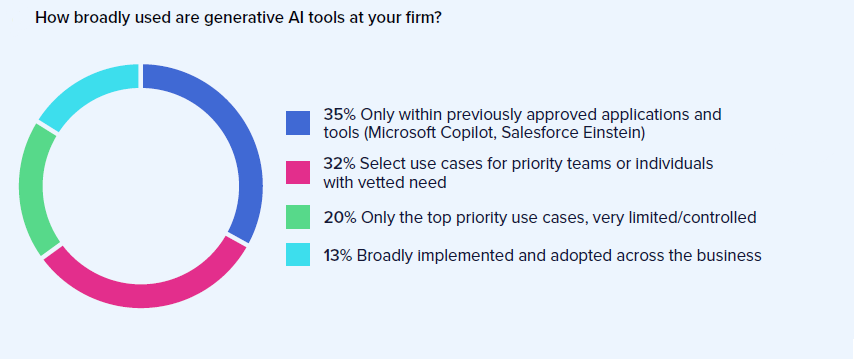

Are firms adopting AI?

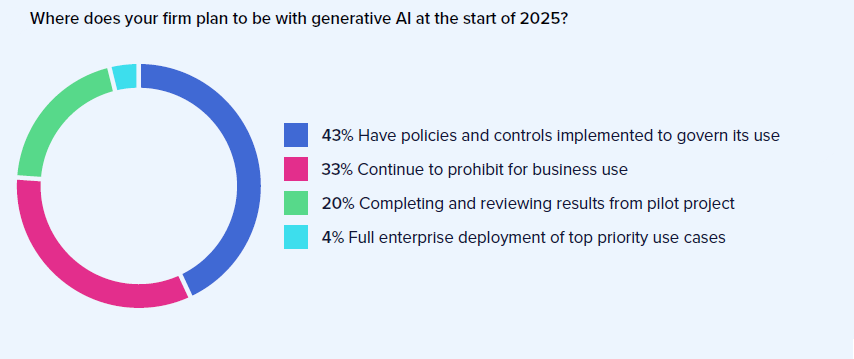

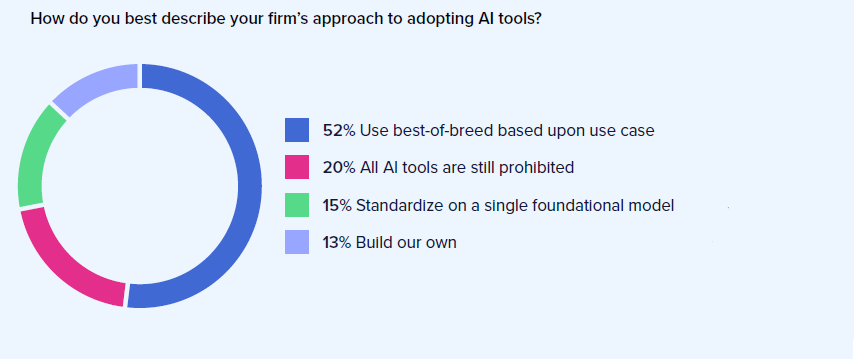

Despite AI apprehensions, many firms are integrating or have integrated AI tools.

The survey results show that AI isn’t going away. In fact, many of your peers are adopting these types of tools, albeit with varying degrees of enthusiasm.

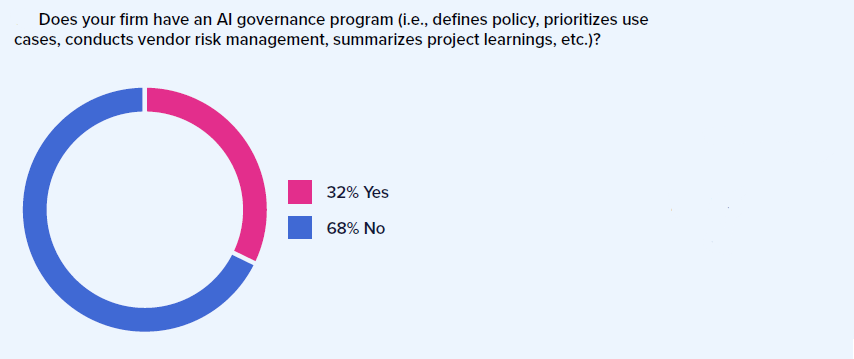

AI and compliance

Fortunately, many firms understand that AI will only gain a stronger foothold in the industry — and in business as a whole — and have started developing or executing AI governance policies to mitigate compliance risks.

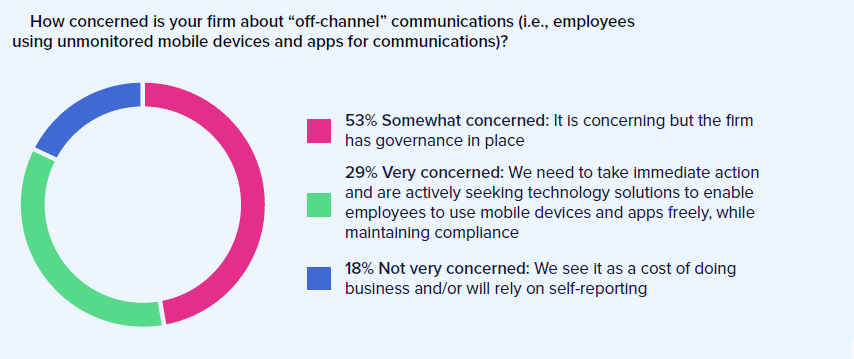

Off-channel communications continue to be top-of-mind

While regulators are still releasing guidance on AI use, their perspective on off-channel communications is clear: they’ll cost you. But what do the survey results tell us?

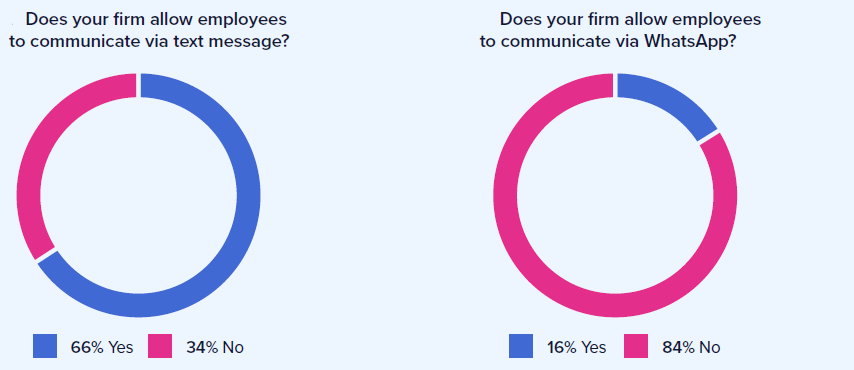

For the most part, the industry recognizes how serious regulators are taking off-channel communications and the majority of firms surveyed (82%) are taking a proactive attitude to mitigate the risk. However, it does appear that prohibition is still a core strategy — particularly for popular mobile apps — which we’ve noted as a less effective approach.

Where do we go from here?

As we’ve seen over the course of the year, AI’s presence in financial services is increasing. Even for firms that are staunchly against their workforce using AI applications, their existing communications tools may be making the choice for them by releasing AI-powered features (e.g., Microsoft Copilot, automatic transcription in Slack, Zoom and Microsoft Teams, auto-complete messages, etc.).

No matter what your feelings are about AI as a business technology, there’s no denying its impact on the industry. Yes, regulatory perspectives are evolving, but it’s a sure bet that regulators will come out with guidance or mandates in the future. What your firm can do is to get ahead of regulatory change with an agile compliance strategy that understands that AI tool use may be used — whether it’s allowed or prohibited.

As the global leader in digital communications capture, archiving and oversight, we help firms simplify communications compliance. This includes initiatives such as integrating with Open AI’s ChatGPT Enterprise Compliance API.

Our solutions are designed to capture the most common (and several uncommon) communication channels, including those powered by generative AI. By expanding the number of channels that can be captured, we empower your firm to allow more channels to minimize the risk of off-channel communications.

Share this post!

Smarsh Blog

Our internal subject matter experts and our network of external industry experts are featured with insights into the technology and industry trends that affect your electronic communications compliance initiatives. Sign up to benefit from their deep understanding, tips and best practices regarding how your company can manage compliance risk while unlocking the business value of your communications data.

Ready to enable compliant productivity?

Join the 6,500+ customers using Smarsh to drive their business forward.

Subscribe to the Smarsh Blog Digest

Subscribe to receive a monthly digest of articles exploring regulatory updates, news, trends and best practices in electronic communications capture and archiving.

Smarsh handles information you submit to Smarsh in accordance with its Privacy Policy. By clicking "submit", you consent to Smarsh processing your information and storing it in accordance with the Privacy Policy and agree to receive communications from Smarsh and its third-party partners regarding products and services that may be of interest to you. You may withdraw your consent at any time by emailing privacy@smarsh.com.

FOLLOW US