The AI Balancing Act: 2024 FINRA AI Guidance on Juggling Innovation and Compliance

As someone deeply immersed in regulatory compliance, I had the privilege of attending two pivotal FINRA conferences this year: the FINRA Advertising Regulation Conference and the Small Firm Conference. Both events featured sessions on artificial intelligence (AI) that provided invaluable insights into how this transformative technology is reshaping the financial services industry. Below, I'm excited to share my key takeaways and reflections on how AI is changing the regulatory landscape for financial professionals.

Why it matters

Artificial intelligence is everywhere, and although regulated industries are understandably cautious, they are also enthusiastic about the potential efficiency and competitive advantage that AI can offer. Organizations should avoid blindly adopting AI technologies and integrations; however, playing the “wait and see” game may cause organizations to fall behind. These insights aim to help firms strike a balance between being cautious and fostering innovation to achieve future-focused goals.

Regulatory framework: How to adapt existing rules to emerging technologies

FINRA's approach to AI regulation is evolving, but its foundation remains consistent and existing rules still apply. This technology-neutral stance means that regardless of the innovation, firms must ensure their AI implementations comply with long-standing regulations. However, FINRA is acutely aware of the unique challenges AI presents and is actively engaging with firms to better understand these hurdles.

A notable moment from the Advertising Regulation Conference was the discussion around FINRA Notice 24-09, issued in June 2023, which served two important purposes:

Affirming existing rules: The notice clarified that FINRA rules and federal securities laws extend to the use of generative AI. This ensures that AI remains within the boundaries of regulations designed to be evergreen and applicable to new technologies.

Inviting engagement: Recognizing the revolutionary potential of AI, FINRA is encouraging firms to share the specific challenges they face when applying AI to supervisory and compliance programs.

The collaborative approach of FINRA Notice 24-09 is encouraging, as it emphasizes FINRA's recognition of the challenges firms face in navigating AI within the current regulatory framework. While the rules are not changing, the expectation is clear: firms must find ways to apply existing regulations to AI technologies. This includes crucial issues like recordkeeping – specifically, how firms maintain compliance with SEC books and records rules when dealing with AI-generated content.

AI in the industry: Where do financial services firms stand on AI?

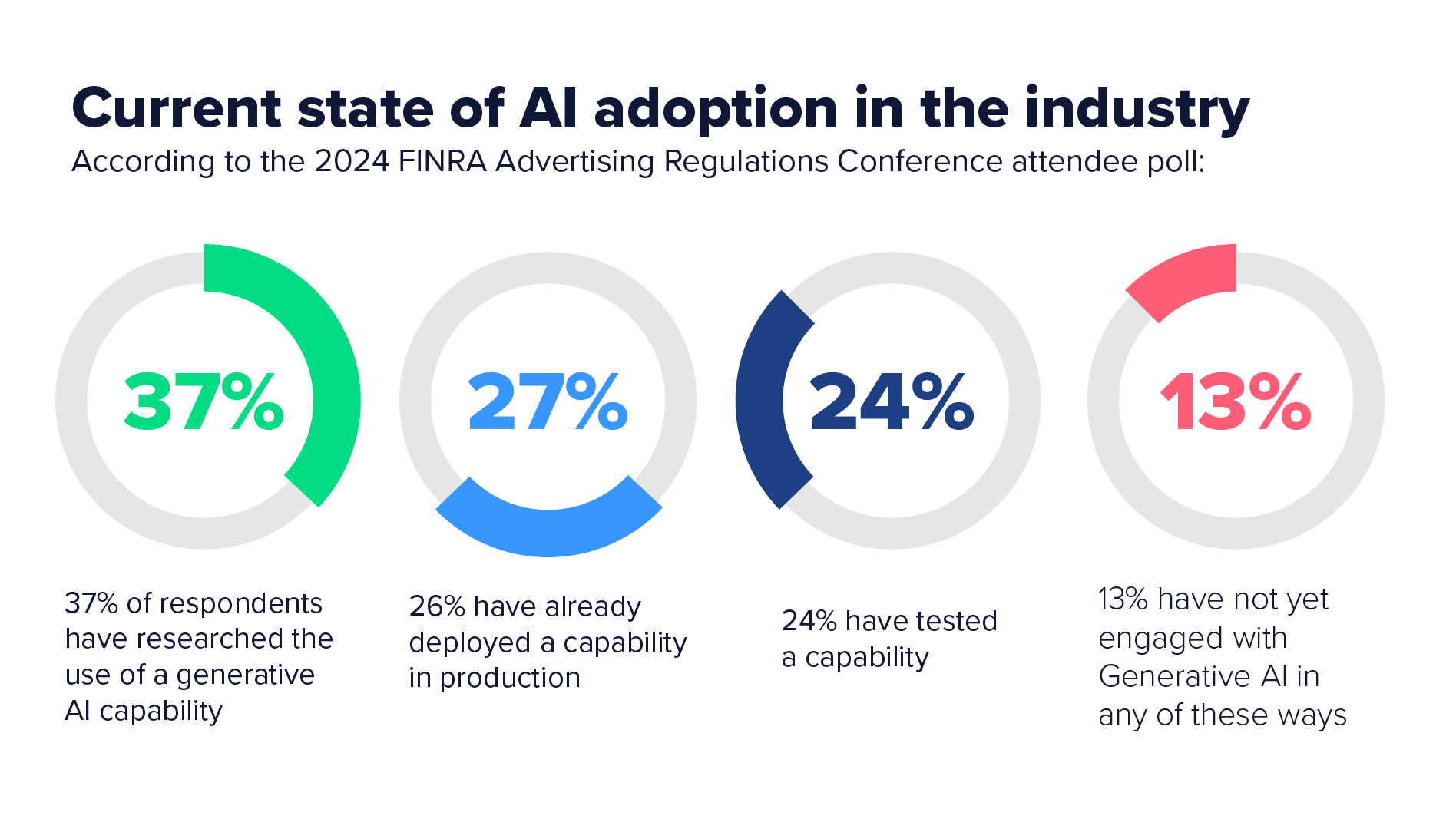

A live poll conducted during the Advertising Regulation Conference provided fascinating insights into the current state of generative AI adoption among attendees:

While these results suggest a cautious approach to AI implementation, the Small Firm Conference revealed that AI adoption might be more widespread than these numbers indicate. Many firms may be unknowingly using AI through off-the-shelf products or vendor services with integrated AI capabilities. Most organizations have caught on that with every software update, the common tools and platforms we use every day could be integrating some element of machine learning, which may not be obvious to the average user. This 'shadow AI' use introduces compliance risks that firms must actively manage.

Unsurprisingly, discussions revealed a dichotomy in AI adoption across different areas of business. While AI applications are gaining traction in various operational processes, firms are approaching implementation selectively and cautiously. Even the most advanced AI tools are fallible. AI lacks human critical thinking as it sifts through the finite amount of information it’s been fed to determine what is true and false, as well as what is applicable and irrelevant. There's a clear recognition that human expertise and judgment remain crucial, even in AI-enhanced operations.

When it comes to customer-facing applications, an even more prudent stance prevails. This caution is understandable given the potential risks of deploying AI in direct client interactions. As one panelist noted, "Right now we have not heard of any generative AI products being used at broker-dealers that are customer-facing." While I think there's certainly an appetite for client-facing AI applications, this measured approach reflects the industry's commitment to thorough risk management and compliance before introducing these technologies to clients.

Best practices: Navigating the AI landscape safely

Both conferences were packed with practical advice for firms looking to implement AI. Here are some best practices that emerged:

Risk assessment: Conduct thorough risk evaluations for each AI use case. As the sessions pointed out, risks aren't uniform across all AI applications. This should be the foundation for all AI implementation decisions.

Ethical frameworks: Develop comprehensive guidelines covering purpose, transparency, manipulation mitigation, and continuous testing. Firms must ensure they can explain the "why" behind their AI decisions.

The compliance journey ahead

The insights from these FINRA conferences paint a picture of an industry at a crossroads. The potential of AI to revolutionize financial services is clear, but so too are the risks and regulatory challenges. The message from FINRA is equally emphatic: we can't let innovation outpace responsibility.

To my fellow compliance professionals, our task ahead is to stay informed about AI developments, actively engage in risk management strategies, and work closely with both our firms and regulators to navigate this new frontier. By doing so, we can help ensure that AI integration in financial services is not just innovative, but also responsible and compliant.

Learn how your firm can leverage the power of generative AI while maintaining compliance with Smarsh Capture for the ChatGPT Compliance API, a compliance solution purpose-built for financial services firms.

Share this post!

Smarsh Blog

Our internal subject matter experts and our network of external industry experts are featured with insights into the technology and industry trends that affect your electronic communications compliance initiatives. Sign up to benefit from their deep understanding, tips and best practices regarding how your company can manage compliance risk while unlocking the business value of your communications data.

Ready to enable compliant productivity?

Join the 6,500+ customers using Smarsh to drive their business forward.

Subscribe to the Smarsh Blog Digest

Subscribe to receive a monthly digest of articles exploring regulatory updates, news, trends and best practices in electronic communications capture and archiving.

Smarsh handles information you submit to Smarsh in accordance with its Privacy Policy. By clicking "submit", you consent to Smarsh processing your information and storing it in accordance with the Privacy Policy and agree to receive communications from Smarsh and its third-party partners regarding products and services that may be of interest to you. You may withdraw your consent at any time by emailing privacy@smarsh.com.

FOLLOW US